House flipping projects can be incredibly profitable, and getting loans from fix and flip lenders is one of the easiest and most common ways to finance them.

However, these loans also have their pitfalls and risks. Failing to understand their functioning and how to pick the right lender might put your house-flipping business in jeopardy by potentially leading to issues like exorbitant interest rates, hidden fees, and insufficient funding.

In this post, we’ll cover everything you need to know about these loans and the five best fix-and-flip lenders to avoid risks and maximize profits.

By the end, you’ll hopefully be able to tell whether this is the best financing option for your projects and, if so, which companies you should rely on.

What are fix and flip loans?

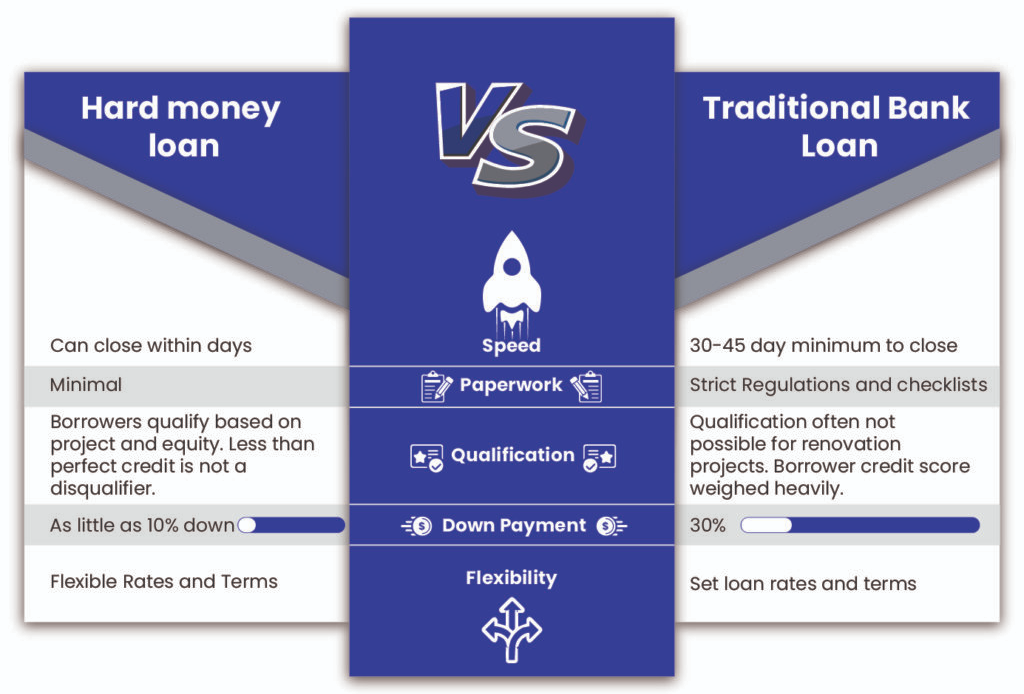

Fix and flip loans, also called hard money or bridge loans, are short-term financing options used to fund house flipping projects (aka, buying, rehabbing, and selling a property). They typically last 12 to 24 months and are offered by private money lenders or non-institutional investors rather than banks.

They often require the borrower to pledge an asset, such as real estate property, as collateral to secure the loan. Because of that, fix and flip lenders tend to care less about the borrower’s credit history, making those types of loans easier and quicker to secure than traditional ones. Additionally, they’re interest-only, meaning you’ll pay only interest in your mortgage payments, while the principal amount will be paid at maturity.

This makes hard money loans ideal for house flipping, as borrowers can quickly finance their projects, resell their properties, and repay the loans within their terms.

Fix and flip loans are usually calculated using the loan-to-value ratio (LTV), which is based on the property’s value at the time of purchase. For instance, if a lender provides an 80% LTV ratio for a $200,000 property, you’ll get a $160,000 loan and must provide the remaining $40,000 as a down payment.

LTV ratios can vary, but some lenders are willing to go as high as 90% for experienced house flippers.

Other standard formulas include the loan-to-cost ratio (LTC), which is based on the project’s total cost, including the repairs, and the after-repair-value (ARP), which represents an estimate of the property’s value after the project’s completion.

Pros of hard money loans (Fix and Flip)

By hinging on the collateral’s value rather than the borrower’s creditworthiness, fix and flip loans bring several advantages, including:

- Fast and Easy Approval: Lenders will spend less time scrutinizing your income, credit history, and documentation, making the application process easier and quicker. Besides time savings and convenience, this might bring additional benefits like enabling you to act promptly and secure valuable properties before competitors.

- No Need for a Strong Credit History: Their focus on collateral’s value makes fix and flip loans more accessible to those who might not have the best credit history.

- Flexibility for Negotiating Repayment Terms: Hard money lenders are often less concerned about repayment due to the increased property’s value after renovation and may be willing to negotiate better repayment terms.

- Interest-Only: Fix and flip loans are more manageable to pay back as the principal amount is only charged at the loan’s maturity date, after which you’ve hopefully already sold the property.

Cons of hard money loans

While fix-and-flip loan programs can benefit real estate investors in several ways, they also have their drawbacks. (some of them can be very costly)

They charge higher interest rates than traditional loans, typically between 8% and 15%, compared to an average conventional mortgage rate of 7.09% in 2023. This means that if you fail to sell the property or a market downturn impacts its value, you could end up in high debt and even lose the property.

But interest rates aren’t the only thing that makes them more expensive. They also charge higher upfront and closing fees and may include prepayment penalties.

Finally, although your creditworthiness alone won’t affect your ability to secure a hard money loan much, you still need cash to provide as a down payment, which can sometimes reach 50% of the property’s value.

Other types of fix and flip financing

Some alternative ways to finance fix and flip projects include:

- Business Credit Lines: Banks may be willing to offer loans or credit lines for house flippers. However, this option is usually limited to those with a solid track record, and a beginner’s odds of getting a business line of credit for house flipping purposes are slim.

- Home Equity Loans: You may be able to secure a loan using your home as collateral. However, that means you may lose your primary residence if you fail to repay it. In addition, banks often require substantial equity from borrowers to qualify for significant funding.

- Personal Loans: For investors with good credit, personal loans offer a straightforward way to finance house flipping projects. However, they may come with higher interest rates than secured loans and impact the borrower’s personal credit if the project doesn’t go as planned.

- 401(k) Loans: Depending on your retirement plan, you may use your 401(k) to secure loans for house flipping projects. Drawbacks include potential taxes and penalties if the loan terms aren’t adhered to and, most importantly, the risk of compromising long-term retirement savings.

Top fix and flip lenders for real estate investment

#1: Kiavi

- Loan Amount: $100,000 to $2,500,000

- Interest Rates: Start at 9.25%

- Down Payment: Starts at 10% of purchase price or 25% of after-repair value

- Loan Term: 12, 18, and 24 months

- Approval Time: Under ten days

Kiavi was founded in 2013 and has become one of the leading fix and flip lenders in the U.S., funding over $16 billion in loans to over 65,000 projects ever since.

It offers an online pre-qualification process that allows you to check eligibility without affecting your credit score and doesn’t require appraisals on fix and flip loans, using an internal valuations team instead. This speeds up the process and enables the company to offer one of the fastest approval speeds in the market, usually in under ten days.

Additionally, it doesn’t charge an application fee or prepayment penalties, and lenders constantly praise the support provided by agents Kiavi’s agents, which has helped the company reach a 4.4-star rating on Trustpilot.

On the downside, it’s only available in 33 U.S. states, a smaller coverage area than other lenders provide.

Pros:

- Fast approval

- No prepayment penalties and application fees

- Excellent support

Cons:

- Small coverage area

#2: Lima One Capital

- Loan Amount: $75,000 to $3,000,000

- Interest Rates: Start at 7.99%

- Down Payment: Starts at 7.5% of LTC or 25% of LTV

- Loan Term: 13, 19, and 24 months

- Approval Time: Under ten days

Lima One Capital is one of the top fix and flip lenders, providing lines of credit ranging from $75,000 to $3,000,000 for borrowers in 47 states.

It offers one of the best interest rates in the market, starting at 7.99%. That’s lower than even experienced house flippers will get from other platforms. The company is also known to be friendlier with first-time flippers than most lenders.

In addition to its FixNFlip program for house flippers, Lima One offers the Fix2Rent solution for real estate investors looking to buy, rehab, and hold rental properties, and the Bridge Plus program, which provides interim financing for investment properties.

On the downside, many borrowers have complained about support issues, including lack of communication and transparency and loans that were vetted at the last minute, preventing them from closing deals. Furthermore, while the interest rates are low, other fees like prepayment penalties can be high.

Pros:

- Friendly with first-time flippers

- Low interest rates

Cons:

- Fees can be high

- Support issues

#3: RCN Capital

- Loan Amount: $50,000-$10,000,000

- Interest Rates: Start at 10.24% (interest only charged on outstanding balance)

- Down Payment: Starts at 10% of the purchase price

- Loan Term: 12 to 18 months

- Approval Time: Under ten business days

RCN Capital is a Connecticut-based hard money lender that stands out for the loan amounts if offers: up to $10,000,000 for multi-family and mixed-use properties. That includes up to 90% of the purchase price and the entire rehab costs, as long as it doesn’t exceed 70% of the ARV.

Additionally, the company offers a friendly application process with real agents that provide support throughout the journey, which can be especially valuable for first-time house flippers.

On the downside, interest rates start high at 10.24% for experienced investors (who completed more than ten flips in the last three years), 10.49% for intermediate ones (three to five flips in the past three years), and 10.99% for new investors. However, they only charge interest over the amount of your line of credit that you’re actually using.

RCN provides capital to borrowers in all but five U.S. states: South Dakota, North Dakota, Nevada, Alaska, and Vermont. Furthermore, it requires a minimum FICO score of 620 and also offers solutions for long-term rentals and new constructions.

Pros:

- Interest rates are only charged over the outstanding balance

- No prepayment penalties

- Large loan amounts

Cons:

- High interest rates

- Shorter repayment terms

#4: Groundfloor

- Loan Amount: $75,000 to $750,000

- Interest Rates: Start at 10.5%

- Down Payment: Starts at 30% of after-repair value

- Loan Term: 12 to 18 months

- Approval Time: As little as 24 hours

Unlike other fix and flip lenders, Groundfloor is a real estate crowdfunding platform that takes money from multiple investors (sometimes, as little as $100) and lends it through fix and flip, full-stack financing, and new construction loans.

It doesn’t require previous experience and offers a lean application process that doesn’t involve hard credit pulls, which could affect your credit score. This makes the process extremely fast, and borrowers can often secure loans in less than 24 hours.

On the other hand, it lends lower amounts and offers shorter repayment terms than other lenders, limited to $750,000 and 18 months, respectively. Furthermore, interest rates start high at 10.5%, and the company requires a minimum credit score of 640.

Pros:

- No experience required

- No hard credit pulls during the application

- Fast approval

Cons:

- High interest rates

- Shorter loan amounts and repayment terms

- Relatively high credit score requirements

#5: Flip Funding

- Loan Amount: $150,000 to $5,000,000

- Interest Rates: Start at 9.99%

- Down Payment: Starts at 30% of ARV

- Loan Term: Up to 24 months

- Approval Time: 10-14 days

Flip Funding is a fix and flip lender that has provided over $500 million in loans nationwide.

The company offers hassle-free funding through a lending method called the Profitable Pairing Process, which quickly matches you with loan options that align with your needs. That includes solutions for house flipping, rentals, and new constructions.

While most loans take ten to 14 days to get approved, lenders are often able to secure loans in seven.

Flip Funding welcomes investors with a minimum FICO score of 620, regardless of real estate experience, and provides loans of up to 70% of ARV. Interest rates start at 9.99%, which is still lower than many fix and flip lenders charge.

Pros:

- Long loan terms

- Quick application process

Cons:

- Relatively high interest rates

Fix and flip lenders – Final thoughts

A single house flipping project can potentially earn you six figures in profits. And, while a hard money loan might be the quickest way to get the funding you need, it’s crucial to understand its functioning and whether this is the best way to fund your project.

If you find that’s the way to go, take the time to talk to multiple fix and flip lenders, research their reputations, and look closely at all the loan terms. Additionally, you can always try to negotiate better arrangements (what do you have to lose?).

By securing competitive rates and terms and only working with reputable lenders, you’ll pave the path to house flipping success while maximizing profits and minimizing risks.

To learn more about what’s coming in the real estate market, check out this post: The Great 2024 Mortgage Panic: Should I Refinance My Mortgage Now?