Are you on the lookout for that sweet spot where your investments work harder and your wallet gets fatter? When it comes to navigating the twists and turns of real estate investing, it can feel like trying to solve a Rubik’s Cube blindfolded.

But guess what – we’ve dug deep into this puzzle and unearthed a gem: “the BRRRR method”. Think of this as stumbling upon a legendary cheat code in the property game.

This nifty strategy is making waves among investors, flinging open gates to potentially limitless returns without putting every last penny you own on the line. Our article strips down this tactic piece by piece, revealing how it could turbocharge your revenue stream with savvy finesse.

Key Takeaways

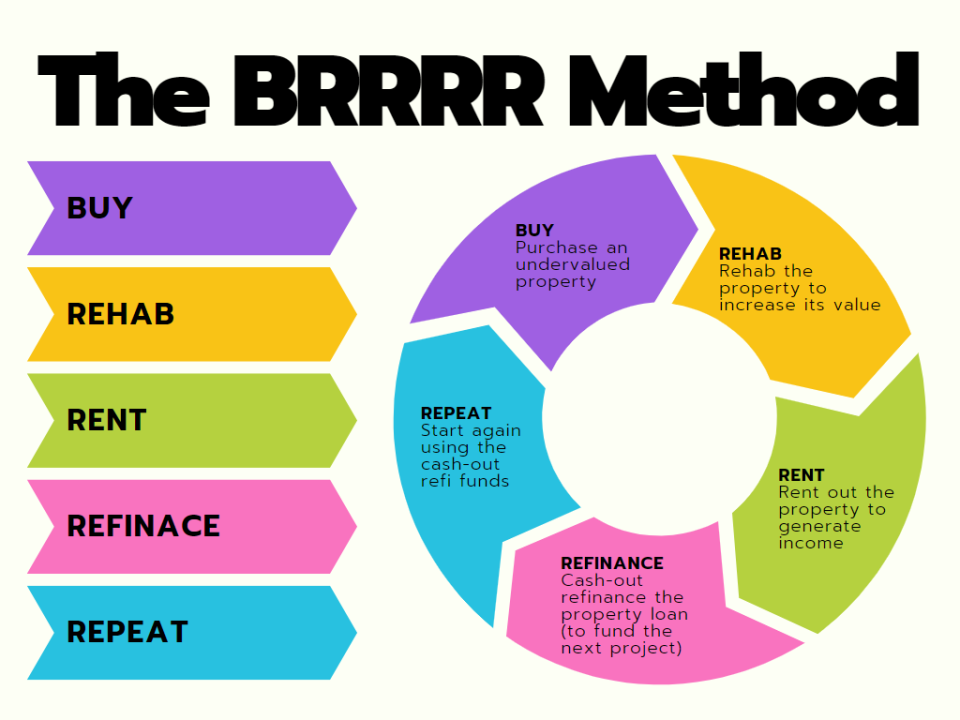

- The BRRRR method involves buying a property, fixing it up, renting it out, refinancing to get your money back, and repeating the process.

- You can start with little or no money down using loans like a HELOC or from hard money lenders and still gain high returns by recycling your initial investment into more deals.

- It’s important to manage risks like going over budget on rehabs, getting low appraisals that hurt refinancing opportunities, and dealing with the costs of short-term loans during renovations.

- Renting out properties quickly is essential in the BRRRR method because rental income covers costs and proves to banks that your property is a good investment for refinancing.

- Scaling up your real estate portfolio can be faster with the BRRRR strategy compared to traditional investing methods as you use gains from each property to invest in others.

Definition of the BRRRR Method

The BRRRR method is a real estate investment plan. It’s like a special recipe for making money from houses. You find a house that needs work, fix it up, then find someone to live in it and pay you rent.

After that, you get some of the money back by refinancing the house at its new value. With this money, you can buy another house and do it all over again.

We love using this method because it lets us grow our investments fast. We turn one house into many rental properties over time without spending much of our own cash.

The key is to pick homes that will be worth more once they’re fixed up – then we make sure the rent checks cover all our costs and even give us some extra income every month!

Breakdown of the BRRRR Method

In the heart of every savvy real estate investor is a strategy that amplifies gains and we’re diving deep into one such powerhouse method.

The BRRRR Method isn’t just a sound you make when you’re cold; it’s a systematic approach to transforming property investments into gold mines, and we can’t wait to unravel its secrets for you.

Buy

We start making money in the BRRRR method by finding a house to buy. We look for places that need work, what we call fixer-uppers. These can be cheaper and give us a chance to add value.

To make sure we don’t pay too much, we use the 70% rule. This rule says our offer should be no more than 70% of the after-repair value (ARV) minus repair costs.

Here is a typical example:

If you find a house that will be worth $200,000 after you fix it up, you should try to buy it and fix it for a total cost of no more than $140,000. (This includes the buying price + the money you spend on repairs.)

For example, if you expect to spend $30,000 on fixing the house, you should not pay more than $110,000 to buy it.

This rule helps make sure you don’t spend too much, keeping your investment safe.

After fixing and renting the property, when you go to a bank to refinance it, the bank might typically lend you around 75% to 80% of the property’s new value.

In our example, that would mean you could get a loan of about $150,000 to $160,000 on a property worth $200,000, assuming it meets the bank’s other lending criteria. This refinancing step is crucial as it lets you get back most of the money you invested, which you can then use to invest in another property.

Don’t forget to factor in legal fees, and closing costs on the purchase.

What If I Don’t Have Enough Cash to Buy & Repair?

Sometimes we don’t have all the cash to buy a property outright. You can get around this this by using loans from hard money lenders or other sources like banks or credit cards.

These loans cover buying the property and fixing it up, which lets us begin with little of our own money down and still leaves room for making the place worth more later on when it’s fixed up.

Another strategy could be to refinance another property you own and get a Home Equity Line of Credit. (HELOC)

Rehab

After buying the property, it’s time to fix it up. We look for things like old roofs, kitchens that need work, and walls with damage. Our goal is to make the house safe and nice for someone to rent.

But we don’t go too fancy – no need for granite counters or super expensive fridges. We keep costs down so we can rent out the place without spending too much.

Rent

Once the property shines after a good rehab, it’s time to find tenants and start collecting rental income. We want to fill our upgraded space with people who pay rent every month. This money helps us cover what we owe on mortgages and other costs of owning the place.

It’s key to have someone living in the property paying rent so we can keep our investment strong.

To get the best results, we might work with property management or advertise ourselves to attract great renters. We aim for reliable folks who will take good care of our place and stay for a while.

Getting this step right helps make sure that our BRRRR method keeps rolling smoothly toward making more money without selling off our properties.

Refinance

We take the next step and refinance after our property looks great and we’ve got renters paying each month. By refinancing, we get back some or all of the money we spent fixing up the place. (ideally we want to aim to get all of the money back).

This is because the house is worth more now than when we bought it.

We talk to a bank about getting a new mortgage at this higher value. They give us cash that hopefully matches or exceeds how much we invested of our own money up to this point.

If you have created a small monthly profit from your renters, and you have received all of your money back from the purchase and repairs, this creates what is called “infinite returns”.

If you think about it, you invested no money to create a monthly cash flow. If you refinance for higher than what you paid in cash that’s even more impressive – because you can use that extra money to go bigger in your next project.

With this cash back in hand, we’re ready to look for another property to start all over again. It’s like rolling our wins into the next game – that’s where “Repeat” comes into play!

Repeat

The magic happens in the BRRRR method when we use our rental property’s gains to dive back in and do it all again. It’s like a game where we level up each time. We take the cash that renters pay us, plus the value we add from fixing places up, and roll it into buying more properties.

This is how our real estate portfolio grows big and strong.

Every time we nail it — buy, rehab, rent out, refinance — we’re ready to hunt for another undervalued house to flip into a money-making rental. Think of this as our power move; using what our current investments bring in to snatch up new opportunities without waiting around.

It keeps our cash flowing and our wealth building fast!

Comparison: BRRRR Method vs Traditional Real Estate Investing

We often hear about the traditional paths to real estate wealth, but let’s dive into the details of how the BRRRR method stacks up against the usual buy-and-hold strategy.

Our goal is to understand the nuances and edge the BRRRR approach might give us in the real estate game.

– Traditional real estate investing requires a significant amount of capital upfront. In contrast, BRRRR allows investors to enter the market with less initial cash by utilizing creative financing options.

– Investors using the traditional approach typically wait for property values to appreciate over time to realize gains. However, the BRRRR method focuses on forcing appreciation through property improvements immediately after purchase.

– Renting out properties is a common factor in both strategies, but BRRRR investors use the rental income to refinance and move on to the next investment swiftly.

– With traditional methods, equity builds slowly as mortgages are paid down and properties appreciate. BRRRR accelerates this process by adding value and refinancing, which quickly increases equity.

– Those who invest traditionally often see a steady but more gradual ROI. On the flip side, BRRRR investors might experience infinite returns by pulling out more money than they initially invested after refinancing.

– Scaling a portfolio can be slower with traditional real estate because of the time it takes to build enough equity to purchase additional properties. BRRRR’s repeatable nature allows for faster scaling.

– Traditional investing might involve long-term loans with stable interest rates. BRRRR, meanwhile, often employs short-term financing during the rehab phase, which can be riskier and more expensive.

– Traditional real estate investment is considered to be lower risk, with a more straightforward, long-term approach. BRRRR, while offering higher potential returns, comes with increased complexity and potential for financial strain if not executed correctly.

| Aspect | Traditional Real Estate Investing (buying properties already completed) | BRRRR Method |

|---|---|---|

| Capital Required | Typically a 20-25% downpayment. | More cash is required. Financing for a property in poor condition can be difficult. |

| Appreciation Strategy | Wait for property value growth | Force appreciation through improvements |

| Rental Income | Renting out properties | Use rental income for refinancing |

| Equity Building | Slow and gradual | Accelerated through refinancing |

| Returns | Steady but gradual ROI | Potentially infinite returns after refinancing |

| Scaling | Slower scaling due to equity buildup | Faster scaling with a repeatable process |

| Financing | May involve hard lending (high-interest) financing during the rehab phase | May involve hard lending (high interest) financing during the rehab phase |

| Risk and Complexity | Lower risk and straightforward | Higher risk with increased complexity |

Why Cash is King in the BRRRR Method

When employing the BRRRR method it’s common to make cash offers when purchasing a property.

This is because many fixer-upper properties that are ideal for the BRRRR strategy may not qualify for traditional financing due to their condition.

You will also likely be competing with other potential first-time buyers or BRRRR investors. Sellers of these properties are more likely to prefer cash buyers, as this ensures a quicker, smoother sale without the complications and potential delays of a buyer getting a mortgage.

Offering cash can also potentially get the property at a better price. This strategy is great in a competitive market where a quick and assured sale is attractive to sellers.

However, it’s important to note that using cash requires significant upfront capital, which can be a substantial financial commitment for the investor.

Pros of Using the BRRRR Method

The BRRRR method offers us a powerful way to build wealth through real estate, and if you’re keen on learning how it can significantly boost your investment game, keep reading – there’s plenty more to dive into.

No Cash? Hard Lending

If you have no cash you can still participate in the BRRRR method with hard money lenders, but there are added risks.

Hard money lenders are private investors or companies that offer short-term loans based on the property’s value rather than the borrower’s creditworthiness.

These loans can be used for purchasing fixer-uppers, something traditional banks typically shy away from.

The advantage of hard money loans lies in their quick approval process and the ability to fund both the purchase and rehabilitation of a property. However, they come with higher interest rates and shorter repayment terms compared to conventional loans.

For BRRRR investors, these loans can be a strategic tool to acquire and rehab properties before refinancing into a long-term, lower-interest loan after the property is repaired and rented.

High potential return on investment (ROI)

The BRRRR method helps us aim for a high ROI. By buying properties below their market value and adding value through repairs, our investment can grow quickly.

Once we refinance at the new, higher value, we often get back more than what we spent. This means our actual cash invested could be very low or even zero over time.

Our initial investment gets recycled into more deals without pumping in fresh funds every time. That’s how some of us reach the point where our returns feel infinite since they can outstrip the original amount we put in!

Scalability

Scalability is a big plus with the BRRRR method. As real estate investors, we can start small and grow our portfolio without putting down lots of money every time. By using this strategy, we buy more properties over time and expand our earnings potential.

We cut costs by managing several investments at once and lower risks by not depending on just one property.

The BRRRR method makes repeating the process easier each time. After doing it once, we get better at finding deals, fixing places up, and getting them rented out quickly.

This means we can take what works and do it again with new properties, growing our business faster while keeping more money in our pockets.

Building equity

Building equity is a key part of the BRRRR method. We buy homes for less than they’re worth and then fix them up. This increases their value. When it’s time to refinance, the house is worth more than before.

That means we can get back most or all of our money spent on buying and fixing the property.

This process sets us up to buy another property and do it all over again. Each time, we grow our wealth without spending much more cash. This way, each investment starts paying off quickly and helps fund the next one.

Accelerating the velocity of money

The BRRRR method speeds up our money’s work. It’s like having your cash do a quick sprint instead of a slow walk. By using this strategy, we can take out the money we invest in one property and put it right back into another deal fast.

This means we get to use the same dollars over and over again to buy more houses, make them nice, rent them out, refinance, and keep growing our investments.

| Pros of the BRRRR Method |

|---|

| 1. Ability to finance with hard lenders. |

| 2. High potential return on investment (ROI) |

| 3. Scalability |

| 4. Building equity |

| 5. Accelerating the velocity of money |

Cons of Using the BRRRR Method

While the BRRRR method can be a game-changer for savvy investors, it’s not without its pitfalls, like unexpected renovation costs and potential rental vacancies, or the banks coming in with lower valuations. Stick with us to uncover how you can navigate these challenges for ultimate success.

Risk of going over budget

We know that sticking to a budget in the BRRRR method can be tough. The rehab part is tricky, and it’s easy to spend too much fixing up a place. We need to pick smart upgrades that add real value without breaking the bank.

It’s key to plan ahead so our costs don’t get out of hand. Short-term loans can cost a lot if we’re not careful. Plus, we should get good appraisals on our properties to avoid surprises later on.

Working with pros who know their stuff helps us keep spending under control.

Risk of low appraisal

Moving from budget concerns, let’s talk about appraisals. A low appraisal can really throw a wrench in our plans. If the house isn’t valued high enough, we might not get the full loan we need to cover our costs and pull out equity.

This is a big deal because it affects how much cash we can take out during refinancing.

The whole idea with BRRRR is to get back our money so that we can invest again quickly. But appraisals are tricky. They depend on the real estate market and how well we’ve improved the property.

Sometimes even great upgrades don’t lead to a high appraisal value. That means less money for us and a slower journey to those infinite returns.

We have to be smart about making improvements that pay off and always prepare for this hiccup when choosing properties for our next BRRRR adventure.

High cost of short-term loans

Short-term loans might be a fast way to get cash, but they come with a high price. We’re talking about steep interest rates that can eat into our profits quickly. These loans are often used in the BRRRR method while we fix up properties.

We need to plan carefully because these costs can stick around for a while.

Potential difficulties in renting out the property

Renting out the property can be tough. Sometimes, you might not find good places or people to rent to. This could slow down getting your money back and growing your investments. You also may face times when house values don’t go up as you hoped they would.

This makes it harder to use the equity from one place to buy another.

To not get stuck, we have strategies for making sure our BRRRR method works well. We look into different ways of financing that can help us get past these roadblocks and keep buying more properties.

| Cons of the BRRRR Method |

|---|

| 1. Risk of going over budget |

| 2. Risk of low appraisal |

| 3. High cost of short-term loans |

| 4. Risk of short term Market deterioration |

| 5. Potential difficulties in renting out the property |

Strategies to Maximize the BRRRR Method

In our journey with the BRRRR method, we’ve unearthed some game-changing strategies that can send your returns skyrocketing, so stick around if you’re ready to level up your investment game.

Using Home Equity Line of Credit (HELOC)

We can tap into a Home Equity Line of Credit, or HELOC, to keep our cash flows rolling. This smart move lets us use the value we’ve built up in our current properties to snatch up new ones.

It’s like having a secret stash that we can dip into whenever a great deal pops up. And since the BRRRR method is all about moving fast and making smooth plays, using a HELOC means we’re always ready for action.

By pulling out funds from a HELOC, we’re not just sitting on equity; we’re putting it to work. We get our hands on more properties without waiting around to save up big pots of money.

With every successful BRRRR cycle, our property portfolio grows stronger and our opportunities expand.

Applying for a conventional loan

Let’s talk about using a conventional loan in the BRRRR method. First, we buy a property with this type of loan. It’s like getting help to pay for our new investment home. We fix up the place next, making sure everything looks great and works well.

After that, we find people who want to live there and they pay us rent every month. Once they move in, we chat with our lender again. This time, it’s for cash-out refinancing where they check how much the place is worth now after all our hard work fixing it up.

If all goes well, we get cash back from the equity we built in the home! This money can go towards investing in more properties.

Using hard money or a private lender

Moving from conventional loans, we can look at other ways to fund our deals. Hard money or a private lender could be the key for us to get fast cash for buying and fixing properties.

These lenders often say yes when banks say no. They focus on property potential, not just our credit score.

We must pick the right lender with care. Their terms can make a big difference in how much we pay back. Using these lenders means we need to know all about the loan-to-value ratios and interest rates they offer.

We have to weigh the costs against possible profits from our investments. If done well, this can lead us toward making great returns again and again with the BRRRR method.

How to Refinance Your BRRRR Investments

When it’s time to refinance your BRRRR investments, we’re diving deep into the nitty-gritty of locking down either a conventional or commercial loan. This is where our initial efforts pay off and we start seeing our investment snowball.

Conventional financing

We often go for conventional financing to refinance our BRRRR investments. This means we use standard mortgage loans you can get from most banks. With these types of loans, we look for the best mortgage rates and terms that fit our budget and savings goals.

Banks usually want us to wait 6 to 12 months before they let us refinance a property. They call this time the “seasoning period.” It’s important because it shows that our rental income is steady and that the property upgrades have added real value.

Conventional loans can be great since they tend to offer lower interest rates compared with other funding choices like hard money lenders or private lending – this helps us save on expenses in the long run!

Commercial Financing

Shifting gears from the more common conventional loans, let’s explore commercial financing. This can boost our game when we use the BRRRR method. We go to banks or lenders who give out commercial loans for big real estate projects.

They look at how good our plan is and how much money the property will make.

We like this because it lets us borrow more than with just a home loan. Yes, the rules are tougher, but if we have a solid deal and know our stuff, going big scale with commercial financing makes sense.

It helps us grow our real estate empire faster by letting us handle many properties or bigger buildings that can bring in more rent money.

Remember, it’s not easy and comes with risks; we need to be smart about every step. But if we do it right, using commercial loans means we could see huge returns on what we put in – maybe even reach those infinite returns everyone is talking about!

Types of Properties Ideal for BRRRR Method

We always look for the right kinds of properties to use with the BRRRR method. Here’s what we keep an eye out for:.

– Fixer-uppers: Homes that need work are great because we can add value through repairs.

– Small multi-family units: Duplexes and triplexes can get us more rent money than single homes.

– Distressed properties: These are houses that may be foreclosed or have owners who need to sell fast.

– Outdated properties: Old-fashioned homes can turn into gems with modern updates and a stylish touch.

– Below-market-value deals: Finding homes sold for less than they’re worth is like getting a head start in the race.

– Properties in up-and-coming areas: We choose spots where people will want to live soon, which means potential growth in property value and rental demand.

We think about these types when hunting down real estate deals that fit the BRRRR strategy perfectly.

Alternatives to the BRRRR Method

If the BRRRR method doesn’t quite match your investment style or you’re looking for a diverse approach to property investment, there are plenty of other strategies to explore. These alternatives each offer unique benefits and can complement your real estate portfolio in different ways.

Turnkey real estate

Moving on from the traditional buy and hold strategy, let’s talk about turnkey real estate. This is where things get a lot simpler for us. With turnkey properties, we can skip the hard work of fixing up a place.

These homes are ready to go and often already have tenants living in them. That means we get to earn rental income right away!

Turnkey real estate lets us take it easy because we don’t have to manage any renovations. It’s like buying a car that’s fresh off the lot—no need for repairs before hitting the road! Plus, this approach keeps our hands free while money comes in each month from rent, making it pretty sweet for anyone who wants to invest but also keep their day job or focus on other projects.

Real estate investment trusts (REITs)

Switching gears from turnkey real estate, we see how REITs offer us a different flavor in the property game. They let us throw money into real estate without owning buildings ourselves.

With REITs, we buy shares in a group of properties and earn money through dividends. It’s like getting slices of cake from several parties without baking anything!

We love that REITs are professionally managed; we lean on experts to handle the tough stuff. Plus, they’re easier on our wallets at the start compared to shelling out big bucks for whole properties with BRRRR.

And if one building isn’t doing so hot, it’s okay because our risk is spread over many properties – that keeps our investment safer and steadier.

FAQs

1. What is the BRRR method in real estate?

The BRRRR method stands for Buy, Rehab, Rent, Refinance, Repeat. It’s a strategy where you buy distressed properties, fix them up (rehab), rent them out to make passive income, then refinance and do it all over again.

2. Can I use the BRRRR method for house flipping?

No, house flipping usually means fixing and selling homes quickly (flips). The BRRRR method focuses on renting out fixed-up homes for long-term income before refinancing.

3. How does cash-out refinance work with the BRRRR method?

After rehabbing and renting the property, you may get a new mortgage with better terms or a higher amount (cash-out refinance). This gives you a lump sum of money that you can use to invest again.

4. Is it possible to avoid paying taxes like capital gains when using the BRRRR strategy?

By refinancing instead of selling (fix and flip), you do not trigger capital gains taxes right away. But always check on things like depreciation recapture or other possible taxes.

5. Are there lending rules from places like Fannie Mae or Freddie Mac that affect the BRRRR Method?

Yes! Fannie Mae and Freddie Mac have certain rules about loans called LTVs – loan-to-value ratios – which can affect how much money lenders will give you when refinancing your investment property.

6. Can I mix other investments like ETFs or mutual funds with my real estate strategy using the brrrr method?

Sure! While they are different types of investments – ETFs being exchange-traded funds made up of stocks that trade like stock themselves; Mutual Funds being an accumulation of stocks managed by experts –you may combine them with your real estate investing as part of your overall financial plan.