As 2024 dawns, homeowners are asking themselves “Should I Refinance My Mortgage Now?” This decision might help some homeowners avoid sinking amidst shifting economic tides.

The Current State of Mortgage Rates

The current average rate for a 30-year mortgage as of November 20, 2023, was 7.82%. Looking ahead to 2024, there are varying predictions about the direction mortgage rates will take.

Some experts anticipate a decline in rates in 2024 owing to cooling inflation and a potential economic slowdown.

A decrease in mortgage rates would be a boon for homeowners, especially those who are considering refinancing. Lower rates mean reduced monthly payments and overall interest savings.

The Fed Rate Watch Refinance tool allows homeowners to find out what a refinance would look like with multiple different lenders.

For instance, a drop from 7% to 6% on a 30-year mortgage can translate into significant monthly and long-term savings.

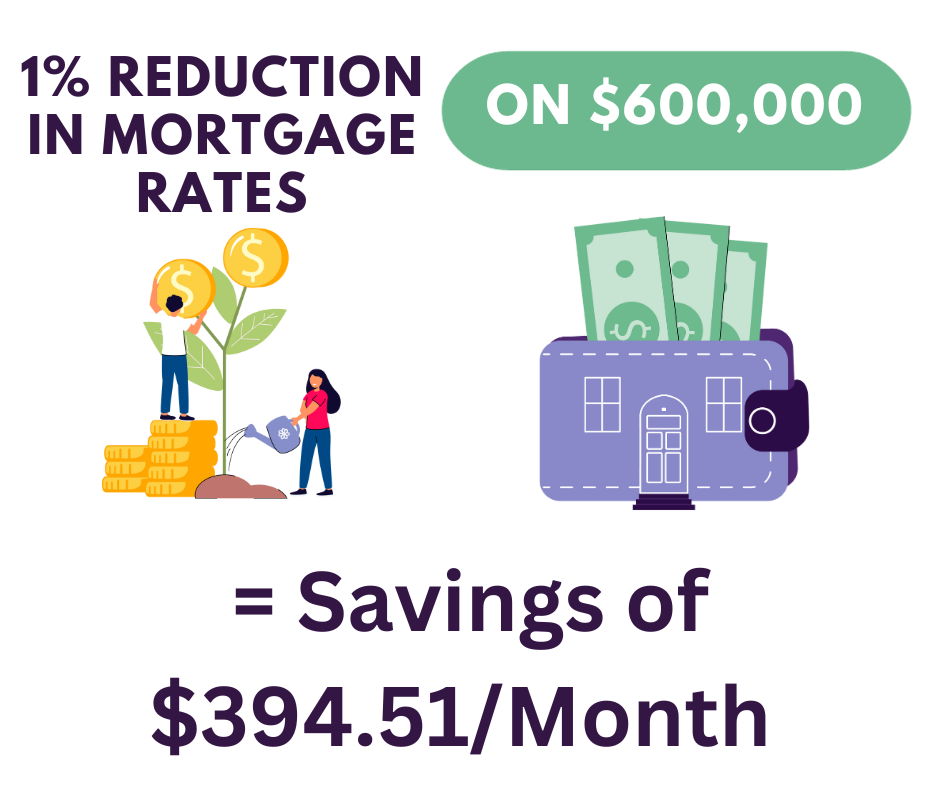

Based on a mortgage amount of $600,000 in the USA, here’s a numerical breakdown of the potential savings from a drop in the interest rate from 7{% to 6% on a 30-year mortgage:

This reduction in the interest rate would result in monthly savings of around $394.51.

Total Savings Over 30 Years: Over the entire term of the mortgage (30 years), the total savings would amount to approximately $142,024.26.

These figures illustrate the significant financial impact that even a 1% decrease in the mortgage interest rate can have, both in terms of monthly budgeting and long-term financial planning.

Refinancing Helps With “Bad Debt”.

Many homeowners asking themselves “Should I Refinance My Mortgage Now” should really be thinking about high-interest debt outside of their mortgage.

Many homeowners, while managing their mortgage payments, are also accumulating high-interest debt from other sources. This situation can arise from various factors, such as:

- Credit Card Debt: Often carrying high-interest rates, credit card debt can quickly escalate due to compounding interest, especially if only minimum payments are made.

- Personal Loans: Unsecured personal loans can have higher interest rates compared to secured loans like mortgages. These are often used for unexpected expenses or to consolidate other debts.

- Medical Expenses: In the absence of adequate health insurance, unexpected medical costs can lead to significant debt, often at high interest if financed through certain loans or credit cards.

- Educational Loans: While typically not as high as credit card interest rates, student loans can contribute substantially to a household’s debt burden.

- Auto Loans: High-interest auto loans, especially for those with less-than-ideal credit scores, add to the financial strain.

Should You Refinance When Rates Are High?

Homeowners who try to time the market could get crushed waiting for an interest rate drop. Smart homeowners are considering options like cash back refinancing, to consolidate high-interest debts into their home loan, which carries a lower interest rate. But at the same time, they are taking advantage of new cash out refinance programs that can avoid penalties or high fees if the rates continue to drop.

Cash-Out Refinancing: This option allows homeowners to use their home equity to consolidate higher-interest debt. It’s particularly beneficial when another debt has high interest rates, providing a way to manage overall debt more effectively.

So if you have $20,000 in credit card debt at 21% interest, and $18,000 in an auto loan at 10% interest, it only makes sense to refinance your home at 6% and pay off $38,000 in high-interest debt.

But What if Mortgage Rates Drop Further?

Homeowners might be trying to “time the market” on interest rates but this could result in a worse situation. Instead of trying to time the market, focus on securing flexible terms. Shop around for lenders that allow for easy adjustments should rates drop. Many lenders are open to this, as they value customer retention.

Additionally, using tools like Fed Rate Watch can help you identify lenders who are more amenable to these kinds of negotiations. This approach ensures you can capitalize on lower rates in the future without being stuck with unfavorable terms.

Leveraging Tools like Fed Rate Watch

In a fluctuating mortgage market, tools like Fed Rate Watch become indispensable. This tool offers real-time data on mortgage rates, helping homeowners make informed refinancing decisions. By comparing current rates with future projections, homeowners can strategize their refinancing moves more effectively.

How Fed Rate Watch Works: Fed Rate Watch provides real-time quotes from numerous companies with flexible terms. No need to predict rate movements. Homeowners can use this tool to weigh the potential benefits of refinancing at different times, considering the unique dynamics of their current mortgage situation.

Should I Refinance My Mortgage Now?

Now is the time to at least start shopping around. In an environment where rates are prone to fluctuation, the choice of lender becomes crucial. Homeowners should look for lenders offering competitive rates and favorable terms, especially concerning renegotiation fees.

If rates continue to drop after a homeowner refinances, the option to refinance again can be financially beneficial. However, this is contingent on the renegotiation fees imposed by lenders. High fees can negate the benefits of refinancing again.

Now is the time for homeowners to negotiate terms with potential lenders. If you wait till the last minute you have less leverage when negotiating. Lenders with more flexible policies can offer a significant advantage in a rapidly changing market.

Personalized Approach to Refinancing

Refinancing is not a one-size-fits-all solution. Factors such as the current interest rate of the mortgage, the remaining term of the loan, and the financial goals of the homeowner play a crucial role in deciding whether to refinance.

Seeking advice from financial advisors or mortgage specialists can provide a more tailored approach. These professionals can offer insights based on an individual’s specific financial situation, which is crucial for making an informed decision.

Risks and Rewards of Refinancing

While refinancing can offer financial benefits, it’s not without risks. Homeowners must consider the potential for interest rates to drop further, the costs associated with refinancing, and the long-term financial implications.

This is why Fed Rate Watch offers the best free solution. Homeowners can refinance with cash back at a lower rate to pay off high-interest debt, which can lead to substantial savings over time, and it can also provide an opportunity to adjust the loan’s terms if rates drop, potentially paying off the mortgage faster and reducing the total interest paid.

Why Shop Now & Not Later?

Homeowners considering refinancing or approaching deadlines, should be acutely aware of the risks associated with waiting. Delaying the decision in hopes of further rate drops or more favorable conditions can backfire, leaving you to contend with higher rates and less advantageous terms. The fear of missing out on the current beneficial terms should be a significant consideration. Refinancing now, rather than gambling on future uncertainties, can provide immediate financial relief and long-term savings.

Conclusion

When considering “Should I Refinance my Mortgage Now?” the decision to refinance in 2024 encompasses a range of factors, including current and predicted interest rates, personal financial situations, and the terms offered by lenders. With tools like Fed Rate Watch, homeowners can gain valuable insights into the best mortgage rates, cash-back programs, and reduced renegotiation fees, aiding in their decision-making process.

As we navigate through the uncertainties of 2024, being well-informed, assessing individual financial situations, and choosing the right lender will be key to making beneficial refinancing decisions. While the potential for savings and improved mortgage conditions exists, each homeowner’s situation is unique, and decisions should be tailored to align with individual financial goals and circumstances.

In summary, refinancing in 2024 offers both challenges and opportunities. A strategic, well-informed approach, backed by a clear understanding of one’s financial objectives and the evolving economic landscape, is essential for homeowners considering this path.